If you're not planning on being in the mortgage for the entire term, this choice may work better for you, so run the numbers to see.īelow the initial calculations, we've provided some examples of your costs over time, including the interest cost and the remaining loan balance after a given period of time. In effect, since the whole amount of your loan will be exposed to this "higher-than-market" interest rate, this choice may cost you more over the long haul. If a lender offers you something different, you can change the information in the box, then re-calculate the results.

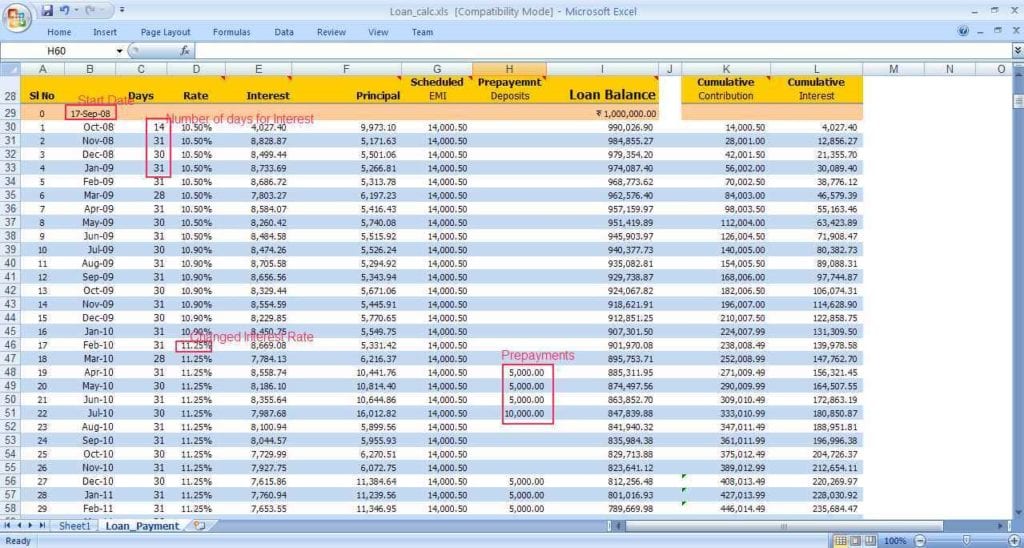

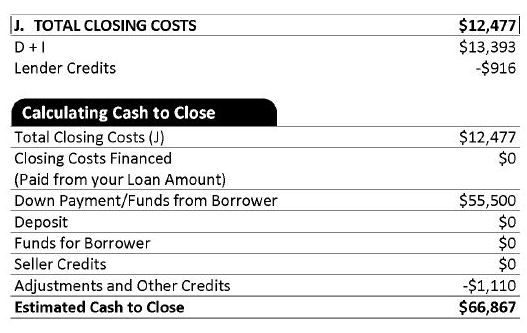

We assume that the interest rate available for a "no-cost" mortgage will be a half-percentage point higher than if you had paid the fees. If it isn't, this higher interest rate can lower the amount of the mortgage you can qualify for, and that might disturb your purchasing plans. Your loan will have a slightly higher than market interest rate, so your income will need to be sufficient to be able to handle the higher payment. However, you are only paying them a little at a time, and depending upon how long you remain in the mortgage, they may cost you more or less than if you paid them right up front, as you would have using the Traditional method.Ī "No-Cost" offer might be your best bet if you don't have cash to spend or available equity to commit toward your costs. Since you are financing the costs, you'll not only pay them but also interest on them. A larger loan balance will raise your Loan-to-Value (LTV) ratio, and may affect the cost of or require you to obtain mortgage insurance, so you'll need to consider this cost if it applies to your situation. If you are a veteran borrowing a VA-backed loan and will be financing all or part of the VA funding fee, make sure you add that cost here to get the most accurate results. If you are an FHA borrower, you should add in your up-front mortgage insurance premium (MIP) in the space provided in this calculator. The Higher Loan Balance calculation uses the Estimated Costs you plugged into the Traditional calculator, and adds them into the outstanding loan balance. In a Traditional method, you pay the fees once, and then they are gone. We assume that typical fees will be approximately 2 points (2 percent of the loan amount) but if they are more or less you can change it just type the expected total dollar amount into the Estimated Costs box. The Traditional Method calculator assumes you pay the closing costs out of pocket today. Learn ways to pay closing costs (click to reveal) (click to hide) Fill in the information once and compare the costs or savings the other choices might bring. HSH.com's FeePay Best Way closing cost calculator will allow you to run the numbers for a traditional method of paying those costs out-of-pocket against higher loan balance or even " no-cost" choices to help you see how the costs of each will work for you over time. Even if all three methods aren't available to you, you'll usually need to compare at least two options. You can't escape running into the puzzle of proper "asset allocation." You'll need to decide how best to use your limited funds to cover a down payment and the fees and costs associated with getting your new mortgage. And yes, even a "no-cost" mortgage choice will have costs! One may be more or less expensive depending upon how long you'll hold onto the mortgage. In all cases, though, the question remains: "Is it better to pay closing costs and fees out of pocket, finance them into the loan amount, or trade them for a higher interest rate?" There's no one simple answer, since each choice has its own benefits and total costs over time. or a little bit at a time? Are you really always better off paying them out of pocket today? What are my options, and how will they work out for me?įor FHA or VA borrowers, upfront costs like the first year's mortgage insurance premium or funding fee can be included in the loan amount. But how? What's the best way? Pay them all now.

Buying a home? Expect to find mortgage fees and closing costs.

0 kommentar(er)

0 kommentar(er)